Third blog in a series by Lisa Crump, founder of Cairn Ventures and Managing Partner, Sofia Fund. View Part I here. View Part II here.

Third blog in a series by Lisa Crump, founder of Cairn Ventures and Managing Partner, Sofia Fund. View Part I here. View Part II here.

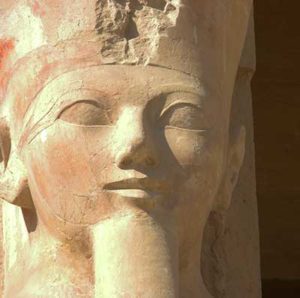

Cash is King Pharaoh*

Conservation of cash is key to building a strong business. Cash gives you ‘staying power’ as you grow your company with an eye to a successful exit. Many savvy entrepreneurs we invest in already have that important attribute of a ‘scrappy’ mindset. I also encourage founders at meet-ups and mentoring hours to be excellent stewards of their cash. Consider all the ways you can be efficient with capital when it is most precious, in the early stages.

When spending funds in order to scale your business and capture the market opportunity, consider these ways to further help you stretch those hard-earned funds:

- Bootstrap operations. Before you lock into fixed costs, look hard at viable, alternative options such as using a co-working office or workshop space to avoid long lease commitments.

- Explore non-dilutive sources, such as grants from the National Institutes of Health, National Science Foundation, SBIR (Small Business Innovation Research) and STTR (Small Business Technology Transfer). Start-up competitions can also be a valuable source of early funding. One Minnesota company co-founded by a woman innovator garnered more than $500,000 in award funding, including first place at MEDA’s (Minnesota Economic Development Association) Minority Entrepreneurship Competition and Grand Prize at the University of Minnesota’s MN Cup. What a way to cost-effectively accelerate product development and get to market!

- Use the services of contractors and part-time employees. Keep connected to your professional services team and read quality business journals and blogs to stay current and informed on proposed legal changes for employment and the gig economy. In Minnesota, companies use the Minnesota High Tech Association’s SciTechsperience program to find college STEM interns at a 50 percent wage match. Determine if you have similar programs to tap into locally.

- For technical companies needing hard-to-find programmers, check out technical schools for qualified students looking for coding project experience or upcoming grads.

- Do you have physical product requirements? If so, see what your local maker space has for options to access inexpensive 3D printing and other tech tools. Check with legal counsel on how best to protect your IP at a maker space, including if using one at a university.

- For low-volume production runs of your product, before committing to tooling, check out additive manufacturing service bureaus. This enables you to cost effectively create parts out of the materials you require to reduce production risks and related expenses.

- Turn to customers to help with cash flow. At Stratasys, the 3D printing company I co-founded, we needed money to buy inventory of our long-lead-time components. Our standard terms were 1/3 down with order, 1/3 at shipping and 1/3 at installation sign-off. In return, customers would realize savings in prototyping costs and reduce lead time in getting their own products to market, while getting ahead of their competition on learning applications. Letters of Credit enabled us to have assured payment at shipment to mitigate the risks of pre-distributor international accounts. Another approach is to see if product crowdfunding is a good match for your product offering.

- Pay yourself and co-founders what you need to get by without causing undue financial stress. Outsized paychecks to founders are a red flag for many angel investors. At Sofia Fund, we believe we’re better aligned when the founders and key team members are compensated and incented with their own stock and options, reinforcing a common sense of urgency to hit key milestones to commercialization. As payroll is a key expense, this reduces the drain on just-raised funds and gives the company further runway.

- Early hires of key employees should be paid competitively, yet as conservatively, as possible. You can’t compete with the traditional benefits of a Fortune 500 company, but you have a powerful early-stage company advantage: employee stock options or other equity offerings. You have a unique, potentially wealth-building way to compensate the risk-taking of your first employees to attract, reward and retain them.

We now are seeing more economic headwinds and mixed global economic indicators. Stay prepared. Remember, ‘Cash is King’ – Actually, ‘Cash is Pharaoh.’*

Think *Hatshepsut, Queen and Pharaoh (Egyptian Ruler, circa 3,000 years ago, noted for her expansion of trade).

This is the third in my blog series on entrepreneurs’ steps to success. View Part I here. View Part II here. I invite you to apply to Sofia fund if you are a woman-led/diverse-led tech-enabled company seeking funding or a co-investor interesting in collaboration. Visit www.sofiafund.com for more information and to read future blogs and follow Sofia on Twitter and LinkedIn.